We’ll go through the meaning of cash flow positive, show you what good cash flow is, and what steps to take for you to get your business cash flow positive as soon as possible.

Specifically, whether or not you’re cash flow positive. And although profitability is certainly something you should be paying attention to, more than anything, the best metric to understand your short-term and long-term survival is by looking at your business cash flow. The biggest balancing act you’re always performing as a business owner is money out versus money in. Your cash flow provides you with a better understanding of your business’s liquidity, flexibility, and overall financial performance. Many businesses track their cash flow on a month-to-month basis. The key word here is “time.” Cash flow can only be understood through the lens of a given timeframe.

In a word, cash flow is the net amount of cash moving into and out of a business at any given time. We hope you have enjoyed reading CFI’s guide to the operating cash flow ratio.Cash flow forms the basis of financial reporting.

#Operating cash flow download

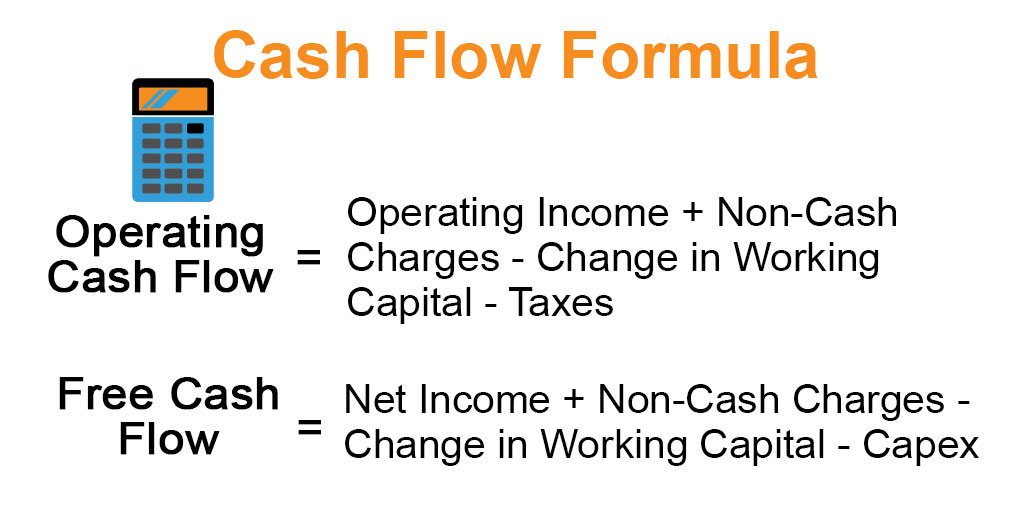

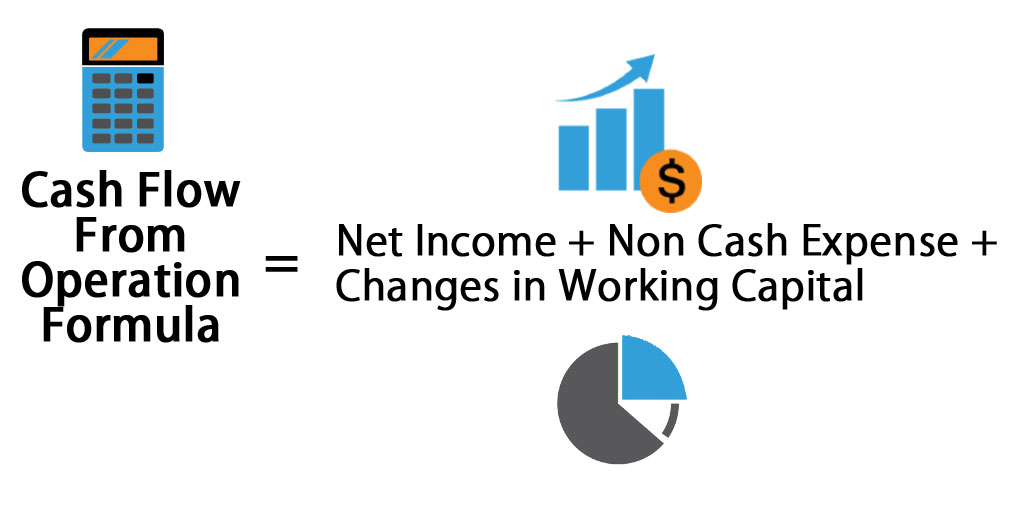

Alternatively, it can be viewed as, “Company A can cover its current liabilities 1.25x over.” Download the Free TemplateĮnter your name and email in the form below and download the free template now! Therefore, the company earns $1.25 from operating activities, per dollar of current liabilities. To calculate the ratio at the end of the second quarter: The following information was taken out of Company A’s Q2 financial statements: A negative OCF indicates that a company is not generating sufficient revenues from its core business operations, and therefore needs to generate additional positive cash flow from either financing or investment activities. If a company fails to achieve a positive OCF, the company cannot remain solvent in the long term. Operating cash flow is intensely scrutinized by investors, as it provides vital information about the health and value of a company. It reflects the amount of cash that a business produces solely from its core business operations. Operating cash flow (OCF) is one of the most important numbers in a company’s accounts. It is important to understand cash flow from operations (also called operating cash flow) – the numerator of the operating cash flow ratio. Examples include short-term debt, accounts payable, and accrued liabilities. Current liabilities are obligations due within one year.Alternatively, the formula for cash flow from operations is equal to net income + non-cash expenses + changes in working capital. Cash flow from operations can be found on a company’s statement of cash flows.The formula for calculating the operating cash flow ratio is as follows: Since earnings involve accruals and can be manipulated by management, the operating cash flow ratio is considered a very helpful gauge of a company’s short-term liquidity. This financial metric shows how much a company earns from its operating activities, per dollar of current liabilities. The Operating Cash Flow Ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Updated ApWhat is the Operating Cash Flow Ratio?

0 kommentar(er)

0 kommentar(er)